You may have heard of Single Touch Payroll (STP).

Single Touch Payroll is a new way of employers reporting payroll activity such as your wage, tax withheld and superannuation to the ATO.

Historically, employers have reported this information to the ATO in an annual payment summary report, and hence provided employees with an annual payment summary (also known as a group certificate).

Under the Single Touch Payroll regime, employers will now report this information to the ATO after each pay run. This allows the ATO greater visibility to each employee and their payroll running balances.

How do I know if my employee is registered for Single Touch Payroll

– From 1 July 2018 large employers with 20 or more employees have been required to report through STP.

– From 1 July 2019 employers with 19 or less employers will be required report through STP.

This simple means, from the 2020 financial year onwards you will no longer receive an annual payment summary, you will now receive an Income Statement directly to your MyGov account.

How does this affect you?

Prior to STP, employers have been required to provide you with an Annual Payment Summary at the end of each financial year. An employer would have until the 14th of July each year to provide this. You would then use this to complete your Tax Return.

Under the STP regime, employers are now no longer required to provide you with a payment summary, instead your information will be available as an income statement. . The information that would normally be available on your payment summary will now be available by logging into your MyGov account. Your employer will have until the 31st of July 2020 to finalise your 2020 payroll information.

How do I access my income statement?

If your myGov account is set up and linked to ATO online services, you need to:

1. Log in to your myGov account

2. Select the Australian Taxation Office from ‘Services’

3. Click on ‘Employment’ at the top of the screen

4. Select ‘Income Statement’ from the drop down

5. On the screen you will see the income you have earned from your employer or employers for the financial year, and the tax that has been withheld. . This is the information that will be used in your tax return.

How do I input this in the Nixer System?

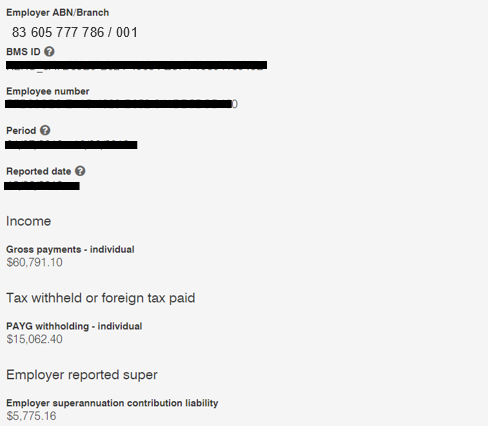

Your Income Statement will look like the following:

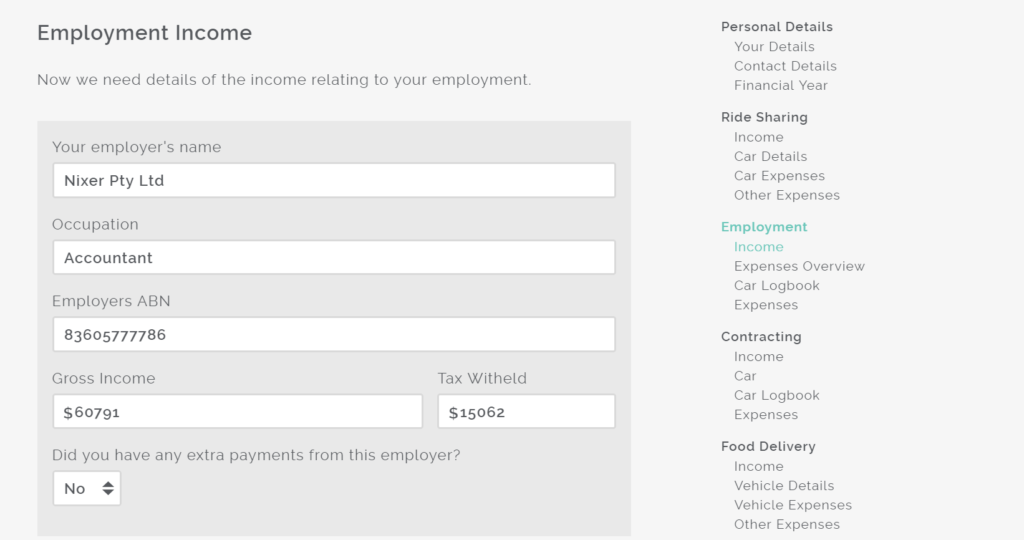

Input Into the Nixer System as follows:

If you would like to discuss any of the above, please contact us any time at support@nixer.com.au