The tax season is a time some people look forward to as they have paid their taxes all year and are looking to get a nice refund to compensate for all the tax deductible expenses they have paid throughout the year. You now need to think about any work related expenses that you have paid Read More

How to access your income statement (payment summary/group certificate) on MyGov

Under the Single Touch Payroll regime, employers will now report this information to the ATO after each pay run. This allows the ATO greater visibility to each employee and their payroll running balances. How do I access my income statement? If your myGov account is set up and linked to ATO online services, you need Read More

JobKeeper – Sole Trader Frequently Asked Questions

The Australian Government passed legislation on 8 April 2020 making the JobKeeper subsidy a reality for struggling businesses. What is the JobKeeper subsidy? JobKeeper is a subsidy administered by the ATO and paid to businesses that have experienced a downturn of 30% or more due to COVID-19. Businesses are eligible to receive $1,500 per fortnight Read More

How much can you claim on tax if you have worked from home?

Much like the rest of the working world, you’ve probably made the shift to working from home. But there’s a lot more to think about than learning how to bake sourdough, and what to dress up as to put the bins out. If your home is now your primary place of business, there are now Read More

Payment summaries have changed!

You may have heard of Single Touch Payroll (STP). Single Touch Payroll is a new way of employers reporting payroll activity such as your wage, tax withheld and superannuation to the ATO. Historically, employers have reported this information to the ATO in an annual payment summary report, and hence provided employees with an annual payment Read More

What is the ATO focusing on in the 2020 Tax Returns?

As technology develops and strengthens, so does the ATO’s scope in finding dodgy deductions. The ATO have recently advised that their data-matching skills have drastically improved over the last couple of years, hence recent warnings issued focused on work related expense claims. The ATO focus on certain hotspots at tax time to investigate taxpayers who Read More

How to pay less tax by contributing to super

As of 2017, almost all tax-payers can make a private, personal contribution into their superannuation fund and then claim the contribution as a personal deduction when they do their tax return. You can contribute any amount provided that your total concessional contributions are not more than $25,000 in a particular year. Remember, the compulsory 9.5% Read More

How to get a higher tax refund this financial year!

The tax season is a time some people look forward to as they have paid their taxes all year and are looking to get a nice refund to compensate for all the tax deductible expenses they have paid throughout the year. There are a few new changes in legislation that can help the common Australian Read More

ATO data matching improvements

The ATO have been hounding lately that they have drastically improved their data matching capabilities. Basically speaking, this means that the ATO will electronically match their data holdings with various different state and territory authorities. If their is a variance between the two forms of data, the ATO may question this and ask you for Read More

Sick of wasting your tax refund? Why not invest it and see the benefits!

Any typical personal who receives a juicy tax refund will go out a buy something that they have long wanted or needed. Some of us have even spent our tax return before we have received it! Here at Nixer we want to help you with some recommendations on how to better spend or invest your Read More

Feel like you are drowning in paper?

Many people who operate as sole traders and even some salary and wage employees get overwhelmed with paper receipts and keeping track of these. Technology has progressed and cloud based utilities have become easily accessible which provides an easy paperless solution to your pile of documents and receipts. Here at Nixer were are completely paperless Read More

Common Deductions that could increase your tax refund

Some people look forward to tax time as they receive some money back from the ATO on their tax return. Whilst these deductions can’t be claimed by everyone, we have put together some of the common deductions that you could potentially be claimed by the relevant tax payer: – The cost of your tax affairs: Read More

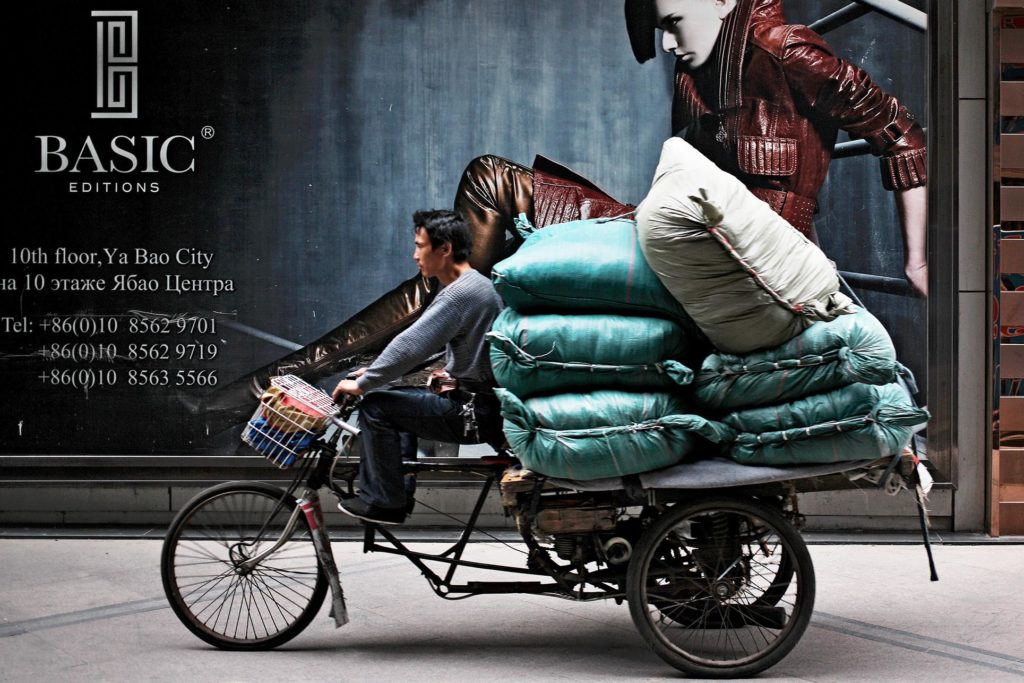

The emergence of the share economy

Over the past couple of years the share sector has emerged into a leading force in the Australian economy. This has been great for employment in the country, as it has allowed for more Australians to be employed and/or operate as sole traders. Uber, Airtasker, Deliveroo, Airbnb and Gocatch are some of the businesses driving Read More

Tax tips & tricks

We understand that not many people love tax time and our goal is to help you to achieve a quick and stress free tax experience. Here are some general tax tips and tricks that will help you at tax time: 1. Keep good records At the end of the day, there is nothing worse than Read More

Introducing Nixer

It’s time for a holiday. Your bags are packed and tickets are booked. You order an Uber and make your way to the airport. Along the way you log into Airbnb, check your booking details for your destination and also confirm what time the Airbnb guest is arriving at your house. The cleaner is Read More